Analysis of the new US-EU tariffs and their implications for Italian companies

Analysis of the new US-EU tariffs and their implications for Italian companies

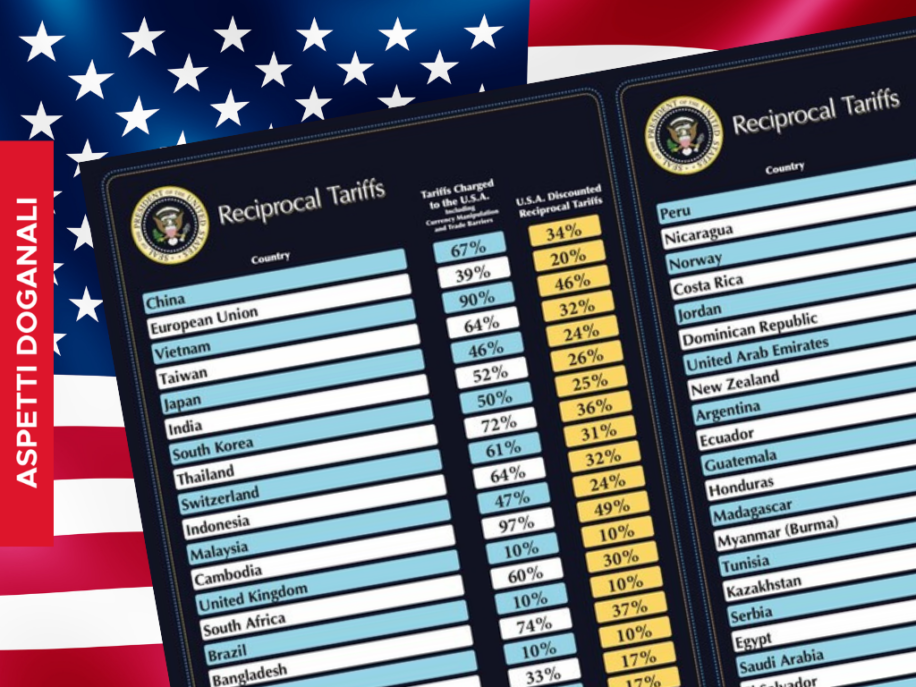

In a context of growing trade tensions, the Trump administration has recently announced the introduction of new duties that directly affect the European Union and, by extension, Italian companies operating on the international market.

These duties range from 20% to 34% depending on sectors and products, significantly influencing the export and import dynamics between the two economic areas.

Table 1: US-EU Trade Value

| Category | Value 2024 (billion €) | Change (%) with new duties |

| Machinery and equipment | 180 | -12% |

| Pharmaceuticals | 120 | -9% |

| Cars | 150 | -22% |

| Steel and Aluminium | 80 | -15% |

| Technological products | 200 | -25% |

| Agri-food products | 60 | -18% |

| Clothing and textiles | 40 | -5% |

| Chemicals | 90 | -11% |

Source: Confindustria

Sectors most affected

Steel and Aluminium

- Current duty: 25%

- Implementation date: Effective 12 March 2025

- Sectors affected: Imports of steel and aluminium into the USA

Automotive sector

- Current duty: 25% on imported cars

- Implementation date: Effective 2 April 2025

- Sectors affected: Imports of cars into the USA, including components

General Sector (Global Tariff)

- Current duty: 10% on all imported goods

- Implementation date: Effective from 5 April 2025

- Sectors affected: All goods imported into the USA

Sector-specific for the European Union

- Current duty: 20% on all goods imported from the EU

- Implementation date: Effective 9 April 2025

- Sectors affected: All goods imported from the EU

Sector specific for China

- Current duty: 34% on all goods imported from China

- Implementation date: Effective 9 April 2025

- Sectors affected: All goods imported from China

Sector-specific for other countries

- Variable duty: Depending on the country, higher duties for countries considered “reciprocal offenders”

- Implementation date: Effective 9 April 2025

- Sectors affected: Varied, depending on country and imported goods

This change in duties represents a significant challenge for the European economy, affecting key sectors that are vital to export and the global economy.

The most affected sectors include automotive, pharmaceutical and mechanical engineering. The tariffs will have a negative impact on the competitiveness of Italian products, which are historically appreciated for their quality but now risk becoming less accessible due to increased final costs.

We examine the impact of specific duties imposed by the Trump administration on various economic sectors in the European Union and how they are affecting international trade:

- Machinery sector: This sector, which includes industrial equipment and machinery, is one of the most affected. The 20% duty on these products can significantly reduce exports to the US, affecting companies that are heavily dependent on the US market.

- Automotive: The automotive industry is under heavy pressure due to specific duties on components and finished vehicles. These duties increase production costs for European car manufacturers and could lead to higher retail prices for US consumers.

- Pharmaceuticals: The pharmaceutical sector is also under pressure, with the introduction of tariffs that could affect both imports of raw materials and finished medicines. This can have an impact not only on the economy but also on the availability of essential medicines.

- Agri-food sector: This sector sees the imposition of high duties on products such as wine, cheese and other foodstuffs. These duties affect consumer prices and could alter existing trade flows, penalising European producers and limiting the choice for US consumers.

- Consumer Electronics: A sector that sees duties increase by up to 20%, with potential effects on the cost of electronic goods from production to retail.

Strategies for Italian Companies

To counter the increase in duties and mitigate the impact on companies operating in international trade, Rosano Law Firm can adopt several legal and commercial strategies:

- Contract Renegotiation: Revise supply and sale contracts to include price adjustment clauses or escape clauses allowing for a revision of the terms in case of significant duty variation.

- Use of Free Zones: Advise companies to operate through free zones, where goods can be imported, assembled and re-exported abroad without paying duties.

- Market Diversification: Assist companies in finding new markets to reduce their dependence on high duty geographical areas.

- International Trade Litigation: Represent companies in legal proceedings against protectionist measures at the World Trade Organization (WTO) or other appropriate international fora.

- Tariff and Product Classification Advice: Offer expert advice on the tariff classification of products to take advantage of lower duty categories or exemptions available.

- Impact Analysis and Future Scenarios: Provide detailed analyses of the impact of tariffs on companies’ business and suggest proactive strategies to anticipate future tariff changes.

US Partial Suspension of Duties

Following international reactions and pressure from governments and trade organisations, the US administration has recently announced a partial and temporary suspension of some of the duties foreseen as of April 2025.

In particular:

- A temporary exemption has been granted to the automotive industry, with the possibility of temporarily excluding from the 25% tariffs some auto components imported from the European Union, in order not to compromise the supply of the domestic US chain.

- The hi-tech sector (electronic components, semiconductors, batteries and embedded software) also benefits from a technical moratorium, useful to ensure the stability of domestic production and the competitiveness of US companies involved in global supply chains.

- At the diplomatic level, the European Union has officially suspended a series of tariff countermeasures on US exports worth 21 billion euros, leaving open a space for negotiation and compromise.

This phase is defined by many newspapers as a “customs truce“, but it is, at the moment, a precarious and potentially reversible measure: President Trump has reiterated that any concession is subject to the political and commercial alignment of partners, and does not exclude further measures if the multilateral negotiations fail by summer 2025

For Italian companies, this temporary window is an opportunity to:

- Conclude pending agreements before full implementation of the duties;Review logistics, distribution and contractual strategies with US customers and partners;

- Explore issues related to customs classification to look for possible exemptions that may still be available;

- Prepare for a regulatory “stop and go” scenario in which it will be essential to have flexible contractual clauses and legal instruments of preventive protection.

Conclusion

In a period of economic uncertainty, adaptability and proactivity are crucial for companies that want to not only survive but also broaden their horizons. By implementing targeted strategies and using specialized advice, Italian companies can orient the sails looking for new markets, strengthening their international and national sales network, expanding the range of products.

The approach of the Law Firm Rosano is oriented to the realization of tailor-made solutions for companies, by drawing up contracts containing clauses allowing for the prior identification of suitable delivery terms and the adjustment of prices according to whether or not duties and other variables are applied, Guiding clients through the turbulence of international trade with appropriate legal and operational strategies.

Rosano Law Firm – 16 april 2025

Studio Legale Rosano

Studio Legale Rosano StudioLegaleRosano

StudioLegaleRosano